Some thoughts on market caps, valuations, tokenomics and unlocks. I have noticed that even many sophisticated crypto twitter participants still don’t know how to use these values to inform their investments or trades. Will write some thoughts and just press publish when I get bored.

The market cap of a crypto asset is the price multiplied by the amount of coins/tokens that are currently in circulation.

FDV means “fully diluted valuation” which is another valuation metric. FDV is the price multiplied by the total amount of coins/tokens that will ever exist (for that asset).

The market cap is always smaller than or equal to the FDV.

The FDV is larger because the term “market cap” counts only tokens that can be bought or sold currently, which omits certain locked tokens that are pending vesting or unlocks. These locked tokens are usually from a bunch of different categories – they can be team tokens and investor tokens and therefore relevant in the next few weeks to years, or they could be tokens in a mining schedule that will be emitted over the next 100 years.

Market cap = demand, FDV = ??

You can imagine the “market cap” as the total $ public demand. This rises and shrinks as the price goes up/down and demand changes – but market cap is basically the total amount of public $ that wants to buy a token at current price.

Where market cap is a measure of public $ buying demand, FDV is not a measure of demand at all. Instead, it is a measure of supply. This is why the fully-diluted valuations get confusing.

As demand increases for unlocked coins and the market cap increases, the FDV increases proportionally, even though demand for these locked coins does not necessarily increase. As a result, the FDV increases 1:1 with market cap even if those locked coins could perhaps have happy sellers at much lower prices.

Scamnario

Imagine a scenario where a project holds a fundraising round, raising $2.5m at a $50m valuation for private investors in January. Private investors are able to purchase at a price of $0.01 per token, but their tokens are locked for one year.

The project launches in February and in March the early users receive an airdrop. This project is under the radar and only a few people found out about it. Because it’s not well-known yet, there’s only $5m of public buyers wanting to be allocated to this new token at any price. The token only reaches a market cap of $5 million in March.

However, the airdrop was for 1% of the total supply. The market cap is $5m and the FDV is 5m*100 = $500m (since the $5m market cap represents 1%). Token price is now $0.10. Seed investors are up 10x.

Now imagine that by May, this project has become the greatest hype project in existence. They’re listed on all major exchanges. They have rumoured integrations with Apple, Disney, Oprah Winfrey and God.

YouTubers are making videos about this project. Now lots more public $ wants to be allocated to this token, so they go to Binance to buy it. The amount of public $ that is willing to be allocated to this token has grown 20x from $5m to $100m.

No new coins have been unlocked because team and seed tokens are locked for 1 year. The market cap is now $100m. The price is $2. The FDV is now $10bn and seed investors are up 200x.

This $95m increase in market demand has caused a $10bn increase in “valuation”. The $2.5m invested in the seed round now sits at a market valuation of half a billion dollars. The team’s tokens are now “worth” $4bn.

However, the seed investors with locked tokens are willing to sell anywhere up to a 5bn valuation, which nets them a 100x profit. That means they are still happy sellers even at a 75% drop from current prices when their tokens are unlocked.

The team are willing to sell tokens at any valuation above 1bn in order to secure long-term funding. They are happy sellers even after a 95% drop when their tokens are unlocked.

Bullish unlock?

So, if unlocks increase supply but not demand, how does a bullish unlock actually happen?

Well, locked tokens can actually have an active market of their own. Professional and sophisticated investors trade locked coins using trust & legal enforcement as their guarantees. Basically, they buy or sell locked coins with a discount to the market price and sign contractual obligations with their counterparty to send the coins as they become unlocked. Sometimes these locked coins even have their lock extended during this OTC sale (particularly if the team is the seller).

Imagine some initial seed investors sold their locked position for a 10x profit to another VC, and this VC in turn sold their position for a 5x. The tokens that are now coming “unlocked” have a cost basis not too far away from the current market price, some market participant’s expectations were that the holders were sitting at a 100x profit. Since some investors expect the unlock event to be bearish, but it is actually neutral, this removal of a bearish catalyst can result in a net bullish event.

If there has been quite an active OTC market for the locked coins and ‘weak hands’ have sold to higher conviction investors, then an unlock event is effectively just the removal of “fear”.

This is kind of what happened with Solana where SOL SAFTs were being sold for 66-80% discount leading up to the Dec 2020 unlock. There was lots of fear amongst locked-coin holders that the unlock would cause the prices to go down, and higher conviction buyers bought up lots of these locked coins. When the unlock happened, these professional investors are sat at a 3-4x instead of much higher multiples.

If there is no OTC market and no demand for the locked coins, then the only way for locked investors to realize profits is to dump them into AMMs or on Binance when they become unlocked and these events can kind of be a game of chicken amongst seed investors.

I would imagine that 90-95% of unlocks happening through 2022 are bearish.

How to identify whether an unlock is bullish or not

Usually professional funds will decide whether it’s a better risk-adjusted trade to buy locked coins for a discount or open market coins. Longer-time horizon investors will generally try to get the lowest priced entry possible and therefore don’t mind buying locked coins.

Without actually just trying to participate in the OTC market (contacting locked buyers, bidding with OTC services, subscribing to OTC ask lists) the main way to figure out if an unlock may be bullish is just to evaluate “is this project good?” – good proxies are perhaps active users, TVL or product-market fit.

If any token has institutional interest, it’s likely that funds have tried to purchase locked tokens if there are any.

Longer-time horizon investors also generally have more sophisticated models of valuation, so imagine them being more like “smart money”. They try to buy at the best valuation they think they’ll get with a 10-year time horizon, so if they think they can buy lower in a couple of years, they’ll likely wait. They’re less likely to fomo buy into parabolic prices like retail investors.

This means as prices go parabolic, the valuation of locked coins and valuation of open market coins detach because smart money is less likely to buy inflated valuations and the locked coin holders are increasingly incentivised to sell (and become happier with larger discounts). In contrast, when markets have grown organically and steadily over time, it’s more likely that the cost basis of locked coins could move up to be closer to the open market valuation.

As bull markets get to later stages generally, smart money risks off and prefers liquidity, so this can be a factor too — later bull market unlocks are more likely to have not recently changed hands.

Unlock schedules

Also important to know the unlock schedule as well as estimating the off-market tokens current cost-basis.

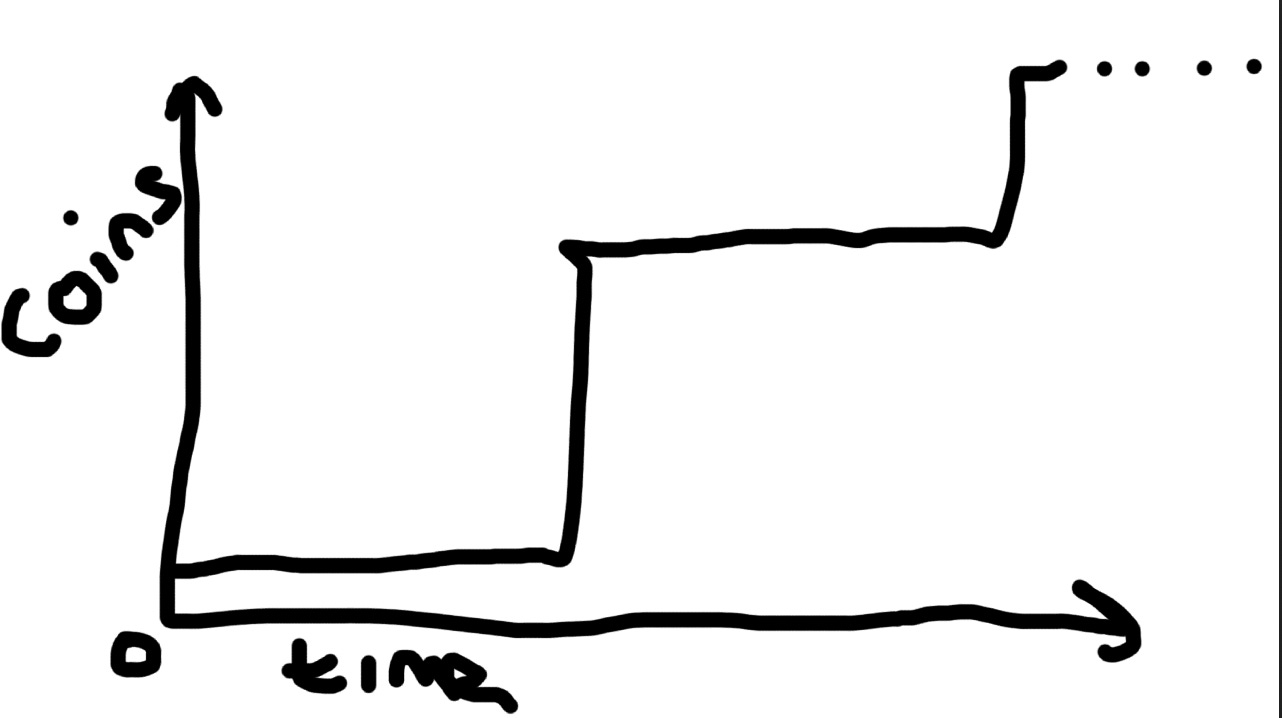

Bitcoin currently has a market cap of $970bn and a fully diluted valuation of around $1.07t. But this extra 100bn unlocks over the next 100 years as part of the ever-reducing block reward. If you were to plot a graph of Bitcoin’s “tokens” becoming “unlocked” through the process of mining throughout history, it would look something like this:

Bitcoin started at a supply of 0 and then increased at 50 coins per block, reducing that reward roughly every 4 years. This will continue to happen until all 21m coins are mined.

On the other hand, projects that raised with private fundraising and issued tokens behind locked vesting to investors may have a supply schedule that looks like this:

In this example, the coin supply starts above 0 (maybe they did a sale to the public, or an airdrop) and then insider tokens get unlocked in large tranches every year.

There’s many other possible examples of graphs with different inflation schedules, I just used two ends of the spectrum as examples.

The most common forms of vesting schedules for team or investor tokens in crypto that I have seen are usually of the format X years locked, Y years unlocking linearly where 0.5<x<1 and 1<y<3. The most common I see for great projects is 1 year locked, 2 years unlocking linearly. Founders can make vesting terms more favourable (less lock/quicker vesting) if they are struggling to raise money.

Why does this matter?

It’s important to be able to figure out any changes in supply and demand throughout the duration of your trade or investment. A “small cap gem” can quickly become a large cap with a poorly timed unlock that you’re not aware of.

But equally, coins with high FDV with upcoming catalysts might occasionally be good trades, since locked tokens could be off the market for a while and other traders may be scared by the high FDV.

Knowing both market cap and FDV is important so you can compare both to similar “peer” projects, too. Trying to get info or a good estimate on locked coin holders’ cost basis is important because it can help inform whether there is additional bid demand from professional investors, or lots of high-profit multiples itching to be sold.

Every single high FDV project’s fully diluted valuation will eventually become unlocked – people should consider the implications of when and how that happens. Sometimes projects will have to execute exceptionally well just to maintain and justify a sideways price.

In sum

Crypto valuation models are difficult because the ceiling is very high and direct financialisation of everything with 24/7 liquid markets is kinda new. Relative valuations can also be misleading due to some kind of anchoring effects.

Project, investors and founders seem incentivised to maximise their fully diluted market cap (and thus private wealth) by funneling as much open market $ into the smallest float possible. By doing this, a project can create vast paper profits for investors and the team.

Some projects will try to force price-agnostic demand through gatekeeping mechanisms such as “you must own this to participate”, mostly recognisable in gamefi but common in crypto generally. Usually in these projects, public valuation detaches the most from private valuation and also from reality.

If a project has a higher “fully diluted” valuation than some of the world’s bigger tech companies, just a year or two since being founded, it’s probably worth wondering: who is holding this massive new wealth, what price did they get it for, and who are they going to sell it to?

if anyone likes free information and read this article till the end here a list of coins with low `market cap / fdv`:

('serum', 0.013112073750009463)

('oxygen', 0.020236146898887933)

('merit-circle', 0.042592000026492556)

('bonfida', 0.04908680262896768)

('star-atlas', 0.060000000065409904)

('illuvium', 0.06347760580886667)

A must read for newcomers. Its unbelieavable that some people "invest" in projects without having in consideration everything exposed here.

But the worse part is that even having no clue, some of them still will make fucking lots of money.