Trading the metagame

Participating in crypto markets during the thrill stages of a bull-run is isomorphically more similar to playing a modern video game than it is to investing.

Most competitive modern video games have an ever-evolving metagame. The metagame can be described as subset of the game’s basic strategy and rules which is required to play the game at a high level.

The meta

In League of Legends, the metagame changes frequently as characters, items and abilities are made stronger or weaker by the developers. Sometimes assassins are extremely strong, sometimes the optimal way to play the game is to play a particular subgroup of extremely strong “jungle” champions. Since certain characters are strong, other characters that are good in response to these meta characters also become popular as a “counter” strategy since they are well-suited to exploiting the weaknesses of these over-powered characters.

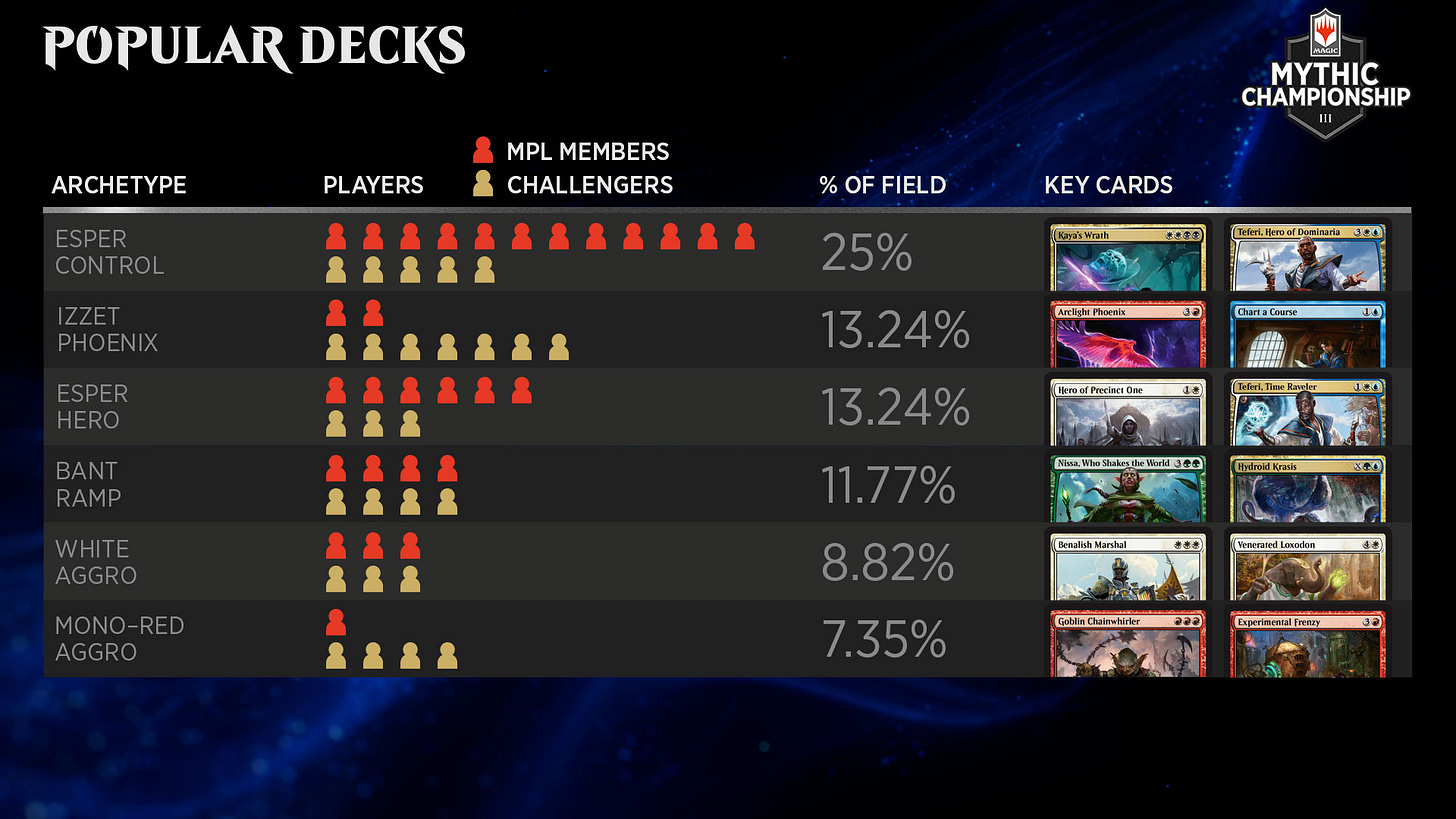

I don’t play Magic: The Gathering but the internet tells me the metagame is dictated by the strong/popular decks, the banned/restricted card list and the best responses to those strong and popular decks.

All other variables equal, knowing and utilizing the metagame gives the player the maximum chance to win the game.

In the bull-market-thrill-crypto video game, there’s a metagame too. Knowing and understanding the metagame is not required to score some wins, but pretty important to continually win when playing at the highest level.

Ethereum killers

Sometimes the metagame is obvious and enduring: throughout 2021, there has been a very clear “Ethereum killers” metagame. Alternative smart-contract platforms have remained one of the best trades of 2021. The “SolLunAvax” metagame sustained & strengthened virtually all year, and their popularity caused this metagame trend to flow down into obscure or fringe alternative L1s too. You could say things like “which L1s have not pumped yet relative to market average?” to participate in this metagame, without even really knowing what that L1 does or if it is actually a good protocol.

Since Ethereum’s fees are exclusionary and broken, this metagame has been durable. Crypto markets are a video game and market participants want to play: they don’t like to be idle during a bull-run. They want to make moves and capture opportunity. Ethereum is too expensive to be active for lots of people. Until that changes, this metagame is likely to remain strong.

Crazy Caterpillars & Dizzy Ducks

Some metagames are fleeting and unsustainable.

For a while in 2021, new NFT mints were a popular metagame. The popularity and success of Crypto Punks inspired projects like Hashmasks and Bored Apes; in turn their success inspired a mimetic trend of market participants confidently searching for “the next big profile-pic NFT series”. These mints were over-subscribed, causing hyped secondary markets. People that missed out on the mint were fomo-buying ‘rares’ after the mint. The profits for early minters further inspired more confidence in participating in these mints. Players begun to see minting these projects as “risk-free”.

Of course, none of these projects were the next BAYC. They were uninspired trend-followers at best and cash-grab scams at worst. Real, sober secondary market demand was virtually zero. Market dilution increased since it was lucrative to be an NFT PFP founder and mint-to-flip was seen as a risk-free trade, thus the best use of capital. Of course, if the best use of capital is to be the mint-to-flip buyer, buyers are focused there and there’s much less money hunting secondary markets. The market quickly reveals that in 99% of cases the person buying on the secondary market is the loser. Secondary market buyers dry up even further, which then makes the mint-to-flip buyer the loser. And suddenly the trend has cannibalized itself with an unsustainable incentive structure.

The biggest winners of this trend were those aware of both the metagame as well as the incentive structure behind the metagame.

Evolution of the metagame

If you go through the last couple of years, the metagame has evolved quite a lot.

In summer 2020, there was DeFi summer, categorised by lots of yield farming and eventually food coins. Towards the end of 2020 there was a Bitcoin dominance run, which then turned into a revival of “blue chip” DeFi with the market being led by Aave. There was an NFT boom, with NiftyGateway sales being extremely profitable. There was a shitcoin season, alt L1 season, and another NFT season but this time dominated by OpenSea. At some point there was an Art Blocks season and a “very old NFTs are good” trend. Alt L1 season evolved into alt L1 ecosystem season with BSC, Avax and Luna coins having their own flourishing ecosystems to varying degrees. Sol-coins did not do so well. Ohm forks eventually became meta. You get the idea.

You’ll notice that it was possible to win the crypto video game by ignoring this changing metagame altogether. You didn’t need to be early to Dani coins to have made good investments in 2021. But, to play at the highest level and maximise wins, you had to identify and exploit the hot-ball-of-money rotations between assets at least a few times.

Maybe more importantly, the biggest losers were formed when players misidentified the current metagame as something else. Anyone that believed the early-2021 metagame was actually a long-term investment thesis ended up holding ROOK from February 2021 through to a -80%. Or, they over-invested into 4th-tier NFT PFP trends that became illiquid and irrelevant.

Usually, metagames start with a long-term investment thesis transitioning to popularity, and end in mimetic exuberance.

Is knowing the metagame enough?

I think for some market participants, simply following the changing metagame is good enough. Especially for those that are able to control their euphoria or are natural skeptics. I’ve seen plenty of people able to spot a trend, jump in, jump out with decent profits and move on without turning their trade into a church.

Yet, for most people, understanding the incentive dynamics behind a metagame is probably way more important.

If you’re playing League of Legends, you can do well by knowing that a champion called Nocturne is the strongest character in the meta at the moment. You can simply play it until it’s no longer in the meta, and have a slight natural edge from the character’s strength.

But, if you understand why Nocturne is strong in the meta, and the changes that happened in the game to cause that boost in strength, you’ll be able to identify the scenarios to exploit those strengths, the pitfalls to avoid, and generally how to maximise your chances to win with this unfair advantage. You’ll also be the first to know when this advantage is no longer applicable (by changes in the game), because you know why the meta exists.

In crypto, understanding the dynamics of why or how a metagame works is much more important than understanding it in League of Legends.

Sol DeFi vs Avax DeFi

A good example of why understanding the metagame’s incentive structure is important is a simple comparison between Avax Defi and Sol Defi.

From a high-level, these two things can look the same. The hypothetical investment thesis is virtually identical.

Avalanche is an alternative smart contract platform, an Ethereum killer, and has been a top performer this year. Native AVAX DeFi is a chance to be early to DeFi in a new ecosystem. If Avalanche is the eventual winning L1, AVAX DeFi is a great buy.

Solana is an alternative smart contract platform, an Ethereum killer, and has been a top performer this year. Native SOL DeFi is a chance to be early to DeFi in a new ecosystem. If Solana is the eventual winning L1, SOL DeFi is a great buy.

So, why did Avalanche coins make so many CT traders rich and Solana coins just stole your SOL? Aren’t they just the same thing, betting on DeFi on an alternative to Ethereum?

Well, being “early” is not about buying the coin on the first possible day. Being “early” is about buying the coin at a valuation that is lower than its potential.

The Solana ecosystem had it’s own “very high FDV” sub-metagame, whereby the only people that were really early were the people that funded the seed round.

Much of the Solana ecosystem’s tokenomics benefited founders and financiers, but meant that the projects were valued as though they had already succeeded and many projects needed to grow into these valuations.

The popular Avalanche coins were much more community orientated and started at reasonable valuations, meaning that as Avalanche grew its userbase, you were able to capture the upside from that growth driving valuations.

It’s a simple example, but shows how understanding the dynamics behind the metagame could have allowed someone burned on soldefi to be more confident on avaxdefi.

Watching winners & solving problems

Usually the crypto meta is rooted in successes. Something works well, and it inspires new founders and investors.

Ethereum has been a huge success. It has inspired thousands of founders and enabled a dynamic and interesting on-chain ecosystem. The success of Ethereum has created multi-millionaires out of believers and supporters.

Often, the crypto meta is also enabled because of failures.

Ethereum has failed at scaling in a way that allows the chain to be used by regular people. It’s prohibitively expensive to use on L1 and the L2s are very new and have their own UX issues.

The “Alt L1” metagame is rooted in Ethereum’s success and enabled because of its failures.

“Winners” are a good catalyst for a meta. People are inspired by the success of a project and they want to look for things that are similar. Founders decide they can build something like that, but better! Investors want to be early for the next version of this great idea.

Axie Infinity’s success created a tidal-wave of capital flows into gamefi. Not only did AXS become one of the best performers of the year, but other thematically related assets also started to perform well, even if they did not have the same metrics or usage to back up their valuations. It spawned an entire metagame. Gamefi became trendy.

Problems and failures are also a great catalyst for a meta. Everyone feels the pain of the problem and trivially sees a world that would be better if that problem were solved. Thus, they rush to be early to buying the solutions. Often the winning solution is not yet clear, but that’s to be expected, because it’s never clear when you are early.

Watching the winners & locating the problems in crypto can be a way of identifying potential metagames in advance.

Community > problems

Sometimes the meta is simply enabled because of the community’s like-minded desire to be early. New market participants simply refuse to buy the bags of rich OGs and instead opt to create their own value.

Some trends in DOGE, SHIB, BSC, BAYC, AVAX, GME, etc can all be seen as having elements of this. They see that something was successful and they have simply decided “we aren’t playing their game, it’s our turn to be rich”.

Perhaps every generation opts out of the previous generation’s ponzi and instead decides to create its own.

Non-narrative metas

There are metagames within crypto that do not rely on the crypto-investment asset narrative too.

There was a period of time where FTX market listings were virtually always bullish, since it was an injection of attention in the middle of a bull market onto a new asset.

For a while, there have been people front-running Binance and Coinbase coin listings. They figure out, either through insider info, an API leak, or whatever method which coins are going to be added to a major exchange, they buy that asset in advance and they sell that asset upon listing.

Follow-trading certain VCs has had it’s moments of being meta. As long as you don’t follow Barry.

On-chain analysis and whale wallet watching has had moments of meta.

There is also a meta in presales whereby bad projects can get funding by all-but guaranteeing profit to their early backers. They raise money at a tiny valuation, offer extremely short vesting, choose investors with big audiences and host an IDO at 20x the valuation that early backers were granted. They get funded, seed buyers are virtually guaranteed a profit, and early backers with large audiences get to say “here’s a thing I am an invested in” as a disclosure (which IMO completely misrepresents the imbalance in risk between their investment and their audiences’ potential investment but I guess is legal). In this meta, founders win and early backers probably win. The meta is weighted against everybody else.

Using the meta

As with video games, using the metagame in crypto gives the player the maximum chance to win. Identifying the metagame allows you to figure out the easiest and most lucrative opportunities at any given time.

A trader called TheDogKennel or something created a portfolio of every single dog coin after the early Doge pumps. He identified there could possibly be a dog-coin meta, and turned $15,000 into multiple million dollars. Possibly the smartest dumb idea I’ve seen all year.

Traders that saw “defi-summer” style dynamics on Avax were able to buy-and-hold the best native Avax dex from sub-1 penny to over $4 because the understood the meta and the dynamics behind the meta.

Identifying the meta and the dynamics behind the meta are probably the most important skills of any shitcoin trader. If you understand the dynamics and incentives, you can figure out whether a metagame has some positive-feedback loop or sustained vector of growth. Or you can figure out if it’s a wildfire rapidly burning out of natural resources leading only to its own demise.

Of course, identifying the meta early, buying the meta coins and selling them into meta exuberance is the ideal and obvious way to use the meta. In general, the most successful altcoiners I’ve met have used the metagame to increase their value-holdings over time (ie. trade meta to stack BTC or ETH).

But the meta is useful for a handful of other reasons too.

Sometimes you can simply see that you missed the current meta and use that info to exit positions that are out of meta to preserve value, or just take a break and restore mental energy. As the meta and attention shifts to new things, capital bleeds out of previous metas. People sell the last meta they fomo’d for the next one. It’s a video game. Players want to play, they don’t want to be idle.

Traders use the meta to exit/rebalance longer-term positions. If you had a big position in some token, which suddenly became meta, even if you have a long-term thesis around the asset, it might be a good idea sometimes to rotate out of it at exuberance and rotate back in when the meta has moved on to whatever is trendy next to compound your position size.

The meta can be used to help decide which assets to leverage trade on derivatives, or to construct pair-trades around. Longing the meta or best-performing assets when you think the general markets look good rather than longing majors has rewarded traders hugely in 2021, where longing SOL and LUNA from the June depths hugely rewarded you vs longing BTC and ETH.

Many traders are stuck using different metagames that are not currently reality. Lots of people have spent the year charting Bitcoin Dominance charts and modeling potential dominance runs because they are referencing a metagame model based on 2017. Other traders have spent the year relying on the Stock2Flow model to inform their trades. Identifying these mental models/metas can help you think more independently about what is happening and identify biases in thinking.

The worst thing you can do is run head-first into a metagame that is reaching exuberance. So, if you already thought 5 or 6 times about taking a trade, weeks/months have passed, and you have finally plucked up the courage to do it: you’re probably too late. It doesn’t feel risky anymore, which means it’s probably maximally risky.

Usually when the meta is common knowledge amongst all participants, the meta is already shifting to something else.

Who else love the fact that "meta" was mentioned 84 times but made sense every single time it was mentioned.

This article is an example of the mental exploration possible when one can devote mental energy to things other than mere survival or carry on with day job. The more people can be free of work, the more brain power will be made available to advancement of thinking , or meta-thinking, that can help us advance as individuals and as societies.