Incentives structures

I ended the last post, (3,3), with this:

Explicating the incentive structures behind financial products and complex crypto schemes is a foresight-superpower in a market populated by retail investors and increasingly obfuscated tokenomics.

“Show me the incentive and I will show you the outcome’ — some old guy, probably Buffett

In many ways, this post is an unintended sequel.

Before I start, please remember I am actually an idiot. I have zero actual financial markets experience, I’m not a financial advisor, don’t understand how money works and barely understand how the coins work. I was born, naked and crying into the cold, sterile hospital light and not much changed since then. These are just my opinions; they might be bad opinions and I might change them tomorrow. Anyway.

Incentives

In crypto, retail investors often seem shocked by market actors’ simple actions: the team sold some tokens, a VC sold their position, the developers did not agree to the proposal to use all of the protocol’s revenue to pump the market and burn the coins, but instead want to invest in “hiring” and “growth”. Monsters.

Surprisingly little time is spent considering the other market participants incentives and deducting their likely actions from their potential actions.

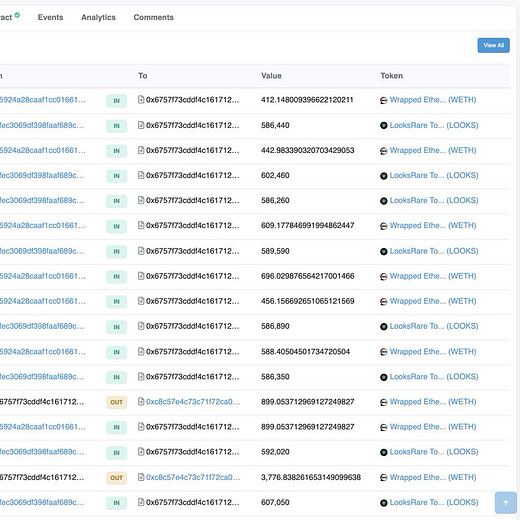

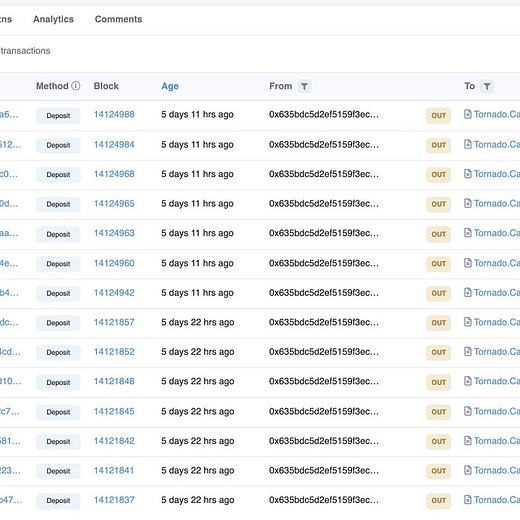

I started writing this due to the LooksRare drama happening on Twitter this week. If you’re out of the loop, LooksRare is an OpenSea competitor with a token that allows holders to share the fees. Some people got upset that the LooksRare team took some WETH from LooksRare rewards through Tornado Cash. It was a typical valentines day. I wanted to write a post about how nobody should have been surprised by this.

While I’ll discuss Looks Rare’s token incentives in this post, I’ll also run through a few other examples of incentives driving markets that perhaps are not well comprehended by market participants too.

Alt L1s

Alternative L1s were a popular trade in 2021. Understanding the crypto market’s retail participants incentives in this instance is very simple: they want to make money and participate in The Great Decentralized Casino.

Alternative L1s provided two useful vectors for these goals:

Very cheap fees — low barrier to entry for retail investors who can’t afford to take several actions on Ethereum.

“Being early as a service” — investors see other assets near their valuation potential, or having completed significant historic price moves. They want to be early to something, predicting better future returns.

To explore all of the incentives at play in these alternative L1s, imagine a fictional alt L1 called Laguna with a fictional DEX called BubbleSwap.

Retail investors: they want Laguna’s price to go up in dollars, and they want to be early to good Laguna-based projects and sell them for a profit to increase their overall holdings of Laguna, and thus eventually USD.

LagunaChain team's incentives: they want the valuation of their network to go up. Practically, this means they want users and builders on their chain. Eventually they want to sell some of their Laguna team tokens to buy a house or a supercar.

BubbleSwap founder’s incentives: they want to get paid to build something useful and possibly later become rich when they’re able to sell some of their BUB team tokens.

Thanks to ecosystems on established chains, users, founders and investors already know that some projects are likely to be valuable. They know that every chain needs a popular AMM DEX. Every chain needs a liquid stablecoin and money market. And yeah, maybe every chain needs it’s own Ohm fork or a dogcoin or something, but they’re less likely to be guaranteed hits.

LagunaChain’s team are incentivised to fund founders and developers to build a DEX and a stablecoin to make their ecosystem viable for casino-goers. They’re also incentivised to fund other projects for casino-goers to speculate on using that DEX. If LagunaChain commits hundreds of millions of dollars of their treasury to incentivise projects to build on Laguna, they can significantly increase the likelihood of LagunaChain’s longer-term success.

Founders see that they can not only get paid by LagunaChain to build something that, if they execute well, has a high chance of success, but also that they can trivially raise money to build this. VCs are chasing the dragon on returns and they are willing to fund pretty much anything. So it’s just Maker, but on Eos, with a logo of a zombie pineapple? I’m in.

As the basics (DEX, stablecoin, etc) are established on Laguna and reach their valuation potentials based on comparable market metrics, these chains begin to support increasingly fringe projects in order to perpetuate the casino and sustain users. Differently motivated L1 teams begin to reveal their hands: you can see L1s founding teams scramble to keep the attention dynamo churning by funding and supporting meritless projects, or you can see them commit to their existing ecosystem and continue building.

Presale Coins

How is it possible for coins to launch and subsequently only go down in the following 6 weeks? Who are these sellers?

Coins launched with the “Influencer-presale” into “low float IDO” often have a similar chart pattern, because the incentive structure is the same in each project.

Taking a look at Kasta, a token released by popular crypto youtuber ‘TheMoonCarl’ in January.

Kasta’s “all time high” was the very first day of trading ($1.13 — Jan 5th) and Kasta’s “all time low” was today ($0.31).

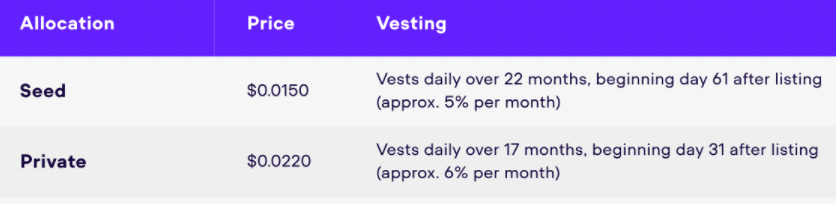

To study the incentives of all market participants, we must first understand who the market participants are. From the Kasta tokenomics document:

Looks confusing initially, but we can simplify these a little into fewer groups. Who are the coins controlled by?

Investors (18%)

Seed

Private

Team/company (71.5%)

Team

Advisors

Ecosystem referrals

Development

Marketing

Operations

General reserve

Rewards

Retail traders (2.5%)

TGE (IDO on Bybit)

Market makers (8%)

Exchanges & liquidity

Now we know who holds the coins, we should figure out what is their cost basis, their hold length and when their coins become available.

First, when do the coins unlock?

Again, these vesting schedules seem quite confusing, but can be simplified pretty easily.

Investors (18% of supply) — unlocks gradually over 1.5 to 2 years, starting 1-2 months after the IDO.

Team/company (71.5% of supply) — unlocks gradually over 2-5 years (averages over 4 years) starting between 1 day and 6 months after the IDO. Specific vesting depends a lot on the tranche, for example ‘Operations’ coins start unlocking 1 day after the IDO and unlock over 2 years, whereas ‘Marketing’ coins start unlock after 1 month and unlocks over 4 years.

Market makers (8% of supply) — available instantly

Retail traders (2.5% of supply) — available instantly

So, in summary, supply starts unlocking pretty quickly and while some unlocks continue for 5 years, some specific tranches (eg investor coins) vest much more quickly (over less than 2 years).

Finally, what is the cost basis of these holders?

Well, the early investors prices are available in the presale marketing document.

Obviously, the team coins are a cost basis of 0. The market makers coins are also at a cost basis of 0, but they’re generally not intended to be sold on market.

The retail buyers cost basis is harder to calculate now with 6 weeks of coins changing hands, but on the first day of trading is likely around $1.

So, why does the market only go down?

On day 1, there was 37m Kasta tokens on the market, with a cost basis of around $1. By 6 months, there will be almost 200m Kasta tokens on the market, with an average cost basis close to $0.02.

Looking a little closer: on day 1, there was only the IDO coins available. Every retail investor that wanted to buy Kasta lined up on day 1 to buy into the IDO allocation. They put all their money into that 2.5% supply available in the ByBit IDO. For the first 24 hours, they were the only market participants, since virtually all other coins were locked.

But, by day 45, there’s two additional market participants.

Investors coins (cost basis $0.02) have been unlocking for the last couple of weeks, and the team’s Operations coins (cost basis $0) have been unlocking for 44 days.

The market has introduced new sellers:

Investors are sitting on >50x profits. They are able to sell 2 weeks of unlocked tokens to recoup their entire initial investment.

Team “Operation” tokens have been unlocking since day 2. The team previously sold tokens in their investment rounds at $0.015 and $0.022 recently, so it seems reasonable that they may also want to sell some tokens at higher prices to secure longer runway.

However, no new buyers have been introduced. Everybody that heard about this product (due to the youtube promotions and otherwise) was ready to buy on day 1. Anybody that waited to buy probably got spooked by the down-only price action. In addition, the product still hasn’t launched, so there is no natural product-based demand.

In fact, the lack of product suggests the rational investors are likely sell their coins on unlock. The $10,000 they invested 6 weeks before the market opened is suddenly worth $500,000. They could sell $100,000 of their Kasta, which secures them a 10x in 6 weeks, and still keep $400,000 invested.

If all private investors want to sell 20% of their tokens, the amount of supply they’d like to sell is 2x larger than the initial allocation available in the IDO.

As prices dip, retail buyers may also want to sell and cut their losses creating more selling pressure.

With lower prices, new buyers might start to become interested. “Well, it’s down 70%, so maybe it’s a good buy here”. And yet even today, seed investors are unlocked daily while still sitting at 15-20x profits, and the team’s coins earmarked for various ‘Development’, ‘Operations’ and ‘Marketing’ activities also are available to sell.

Perhaps the team thinks selling 5-10% of their overall remaining equity to secure long-term fundraising through a bear market is a good idea. Hopefully they can secure that OTC with a professional fund, causing no market impact, but it is within their power to sell it on the open market too. It might even be the right decision long-term for the project to temporarily tank the market to ensure they have the funds to build through a crypto winter. Still, such an action would not be great for the token price in the short term and while the team might not intend to do it, the lack of significant cliff in the vesting makes it a possible action.

This pattern of token incentives is also the reason that popular crypto influencers and youtubers often promote coins they “invested” in — seemingly disclosing their vested interest — but then these coins only seem to go down.

Did the youtuber lose too, are they a bad investor?

Usually no, they’re invested at a significantly lower valuation. The youtuber invested in a presale and will be at a profit even if the market crashes 85%. They are disclosing their financial interest, but not disclosing the asymmetric risk that their audience would be taking. They are invested, but at a much lower valuation that was not attainable for their audience. Meanwhile, the audience has to pile into the low float available at IDO.

Looks Rare

Would like to state before I dive in: I don’t own $looks, I am not long nor short $looks on any perps platform, I don’t own OpenSea equity, I did not buy the $looks seed round. Some of my friends (Ledger, Path, Gainzy) did buy the $looks seed round. Oh I don’t own any Kasta or any short-Kasta exposure either.

Anyway, I started writing this post to explain the tokenomics incentive structures that were public in Looks since day 1. I wrote a thread about it on Twitter but there’s no edit button and threads are pretty useless at long-form writing.

How did the Looks team earn 10,000 WETH?

LooksRare issues the fees earned on the marketplace to users that have staked their $looks tokens. If the marketplace earns 1000 ETH, that ETH goes 100% to stakers of $looks.

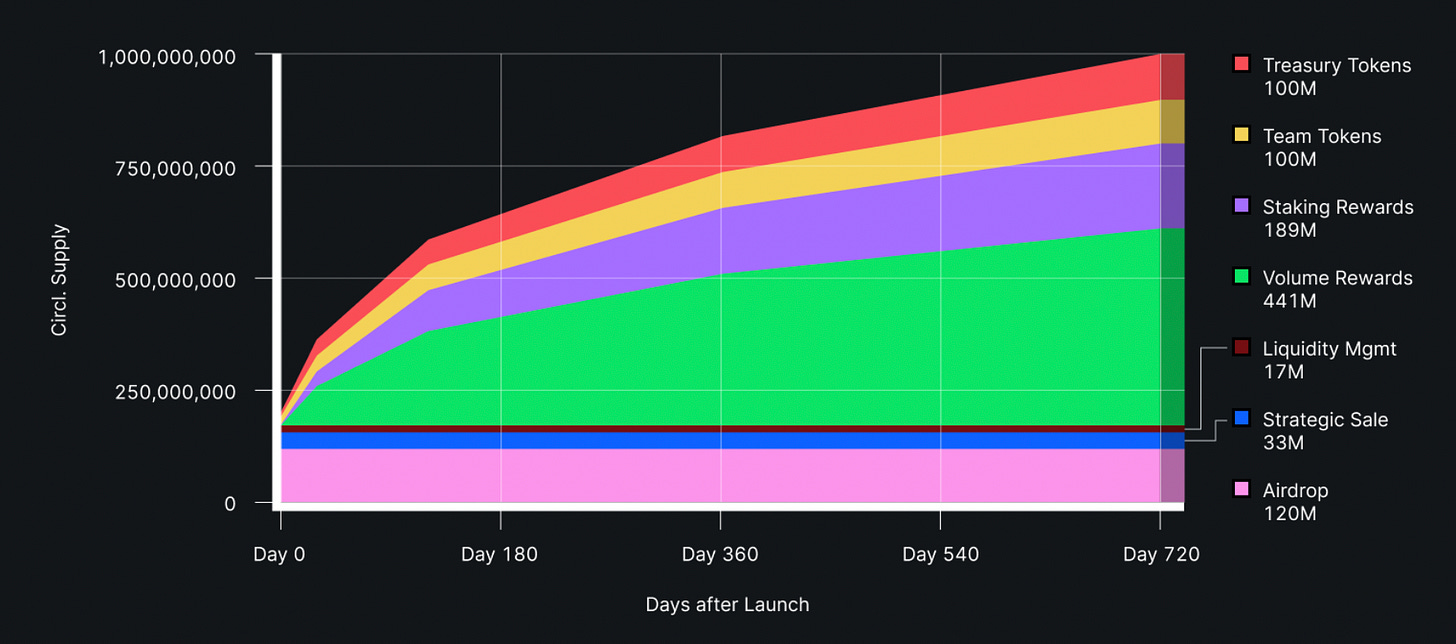

On first glance, the tokenomics suggest that this reward is 75% community owned, with only 3.3% going to the early seed investors.

But, not all of these tokens are eligible for staking. For example, the Community’s “staking rewards” and “trading rewards” are earned over several years and thus cannot be staked on day 1.

The “seed investors” strategic sale coins are locked, so they cannot sell them, but they are stakeable, so they earn full rewards from day 1.

If you were to recreate the infographic above with eligible-for-staking tokens on day 1, it would look more like this:

70% airdrop

20% seed investors

10% liquidity management

The team’s tokens also have a staking schedule, making them eligible for staking over time. The staking unlock schedule:

There’s additional nuance, though. There is a mechanic in LooksRare that prevents the Community staking rewards to accrue to the seed investors and the team.

This means that the seed stage backers get steadily diluted over time. Initially they have 20% of the stakeable supply, but as time passes it trends towards 3.3% over a couple of years.

By day 180, 100s of millions of $looks has been released in volume rewards, and 10s of millions of $looks have been released in staking rewards (emitted only to stakers of airdrop and volume rewards sourced tokens), meaning the seed stage buyer’s share is significantly smaller as a proportion of the stakeable supply.

Finally, you must take into account ‘dormancy’. There will be inefficiencies and lack of staking adoption in user-owned coins: perhaps users don’t know about LooksRare, perhaps they didn’t claim or stake their coins yet; at the very least, perhaps they are slow to stake the new emissions and don’t do so daily. While staking adoption is very high (>85%), it does mean some stakeable community supply is not participating and thus a higher share of rewards for seed backers and for the team, since there is much less likely to be inefficiency and staking adoption in team-owned and seed-owned coins.

So… where did 10,000 WETH come from?

It’s pretty simple, I’m not sure why people were shocked. Maybe Tornado Cash just triggers people.

Anyway, the stakeable supply earns the WETH from fees. The team’s share of stakeable supply unlocks gradually. While they’re staking, they get a portion of the WETH from fees.

And the fees have been pretty high. On February 1st, 7,230 WETH was earned in fees by all Looks stakers.

The team’s share of the stakeable supply at this time was around 12%, meaning from this single day of staking the team earned 860 ETH. As you can see, with 860 ETH in one day earned from staking, it’s pretty easy to see that the team made 10,000 ETH from their minority share of staking over the time since launch.

As for Tornado Cash, I’d speculate that the team needs to remain anonymous for regulatory purposes.

The more interesting question is…

Why were users paying 7,230 WETH in fees in a single day?

In addition to staking $looks to receive $looks staking emissions and WETH fees, users can also earn $looks by trading using the LooksRare platform.

Users earn a share of the daily LOOKS rewards proportional to their volume. This ‘volume reward’ acts like a perpetual token sale.

Users trade NFTs on the LooksRare platform and spend fees. However, they receive $looks tokens proportionally to their volume or fee spend. Their fees are reimbursed through $looks. Effectively, they are spending WETH to buy $looks.

Every single day there is a certain amount of $looks available for ‘purchase’ via volume rewards, where the price is derived by the ongoing daily auctions.

Since $looks has a market price, fee-spending wash-traders are aiming to pay less in fees than they earn in $looks.

If $looks is $2 and the daily volume reward is 1,500,000 LOOKS then it’s likely that the WETH rewards for that day will be close to $3,000,000.

It’s unlikely to be significantly higher because then wash-traders have spent $4,500,000 in WETH to buy $3,000,000 in LOOKS.

It’s also unlikely to be significantly lower, because the opportunity to buy $3,000,000 in LOOKS for $1,500,000 will be arbed out by the market relatively quickly.

Some volume-reward earners will be looking to establish long-term $looks positions at best possible entry, and so slightly below market price is attractive to them. However, some volume-reward earners are aiming to earn more in LOOKS +EV than they spent in WETH per day and thus will sell their LOOKS to WETH to repeat this process the next day, compounding their WETH returns.

This means a portion of volume rewards will be daily selling pressure, causing a reduced price of $looks, thus reducing the daily available $-volume rewards, thus reducing the amount of WETH spent on fees and returned to stakers, thus reducing the APY from staking and therefore creating the negative flywheel that we’ve seen tank the price from $7 to $1.50. This may also be impacted as the volume rewards reduce as per the Looks schedule, causing the wash trading to also reduce, reducing the overall WETH fee staking reward.

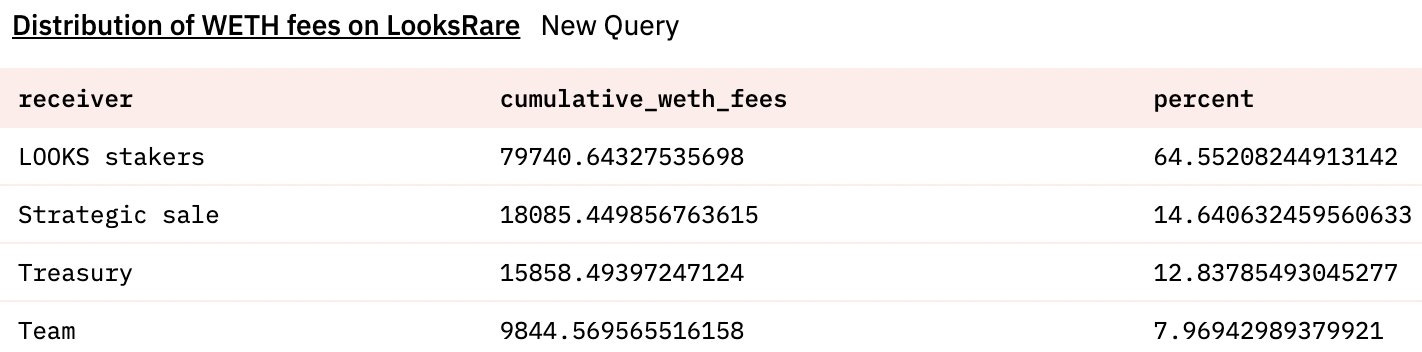

The main difference in this perpetual token sale from a traditional ICO is that the returns of the token sale are returned to $looks stakers rather than solely to the team. Of course, the team are participating in staking (~10% of staked supply) but 65%-70% of the stakers are community members staking that received coins from the airdrop or from volume rewards.

I’m not sure if this model is good, or bad, but it’s certainly a novel attempt to distribute a community-owned token and build a marketplace with fees returned to all stakeholders rather than disappearing into the Opensea void.

When projects distribute their equity or ownership, they should aim to be buying something valuable in return.

With their aggressive looks-for-fees emission, LooksRare token holders are buying fees (WETH) and attention. I’d actually prefer more of the WETH to go to the team for war-chest building, and personally think there’s stickier forms of user engagement, but since attention is the scarcest resource in crypto it’s likely still an effective investment if the team and stakeholders are able to translate this attention into real, engaged and retained users.

In some ways, LooksRare has been a victim of its own success. The high market price and valuation of LOOKS commanded high $-amount daily LOOKS emissions, in turn generating lots of WETH rewards and a bit of a ponzinomics flywheel. As the circulating supply distributes and fake-volume incentives reduce, LooksRare becomes an interesting community-owned alternative to OpenSea if it is able to sustain real volume.

Fees are already distributing mostly to the community, and their share will only increase over time too.

They could’ve probably made the seed stage share of staking rewards a little clearer, and perhaps figured out some way to reduce the buy-to-dump volume flywheel (volume rewards return locked coins perhaps)… but, then they wouldn’t have a warchest to build with and, well, would we be talking about LooksRare today?

Pls let me know if I fucked up any calculations or whatever. I, as always, am not bothering to proof-read this post. Thank you for being my crowd-sourced editors.

Great read as usual Sir!

If I may, you could have just skipped your "I am nobody, I am nothing" introduction though.

"The pride that prides itself under modesty is the most unbearable of all". M.Aurele.

You're brillant, your records speak for you, you know it and everybody knows.

No need to brag but, the same way, no need to "falsely" shame yourself.

Thanks for everything.

With love and respect.

Love your post. But just wondering wouldn't the negative flywheel works both ways and become a powerful uptrend when looks price starts trending up? Looks price increase resulting in higher $ looks volume and higher weth and so on and so forth